maine property tax calculator

The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses. This unit is responsible for providing technical support to municipal assessors taxpayers legislators and other governmental agencies.

Maine 2022 Sales Tax Calculator Rate Lookup Tool Avalara

The amount of tax is determined by two things.

. Municipal Services and the Unorganized Territory. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Maine property tax records tool to get more. Please contact our office at 207-624-5600 for.

Maines median income is 55130 per year so the median yearly property. Our Maine Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property. Our Washington County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

Manufacturers suggested retail price MSRP How is the excise tax calculated. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes collected.

The Property Tax Division is divided into two units. But first take a look at what the assessment actually does to your annual real property tax payment. Our Hancock County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Maine property tax records tool to get more. Our Oxford County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property. Estates above that threshold are taxed as follows.

Your average tax rate is 1198 and your marginal tax rate is. Information Needed on Property Tax Bills PDF 2022 Tree Growth Rates PDF 2021 Property Tax Legislative Changes PDF 2022 Municipal Valuation Return MVR MS Excel 2022 MVR. Maine Income Tax Calculator 2021.

How much is the excise tax. The age of the vehicle. Carefully calculate your actual property tax including any tax exemptions that you.

Our division is responsible for the determination of the annual equalized full value. On average homes in Maine are worth 212047 with homeowners paying 1190 for every 1000 in home. For deaths in 2021 the estate tax in Maine applies to taxable estates with a value over 587 million.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Maine property tax records tool to get more. If you make 70000 a year living in the region of Maine USA you will be taxed 12188. Of that 28 billion or 2338 of total revenue collected is from property taxes.

8 on first 3 million.

Property Tax Rate To Decrease For Lewiston Homeowners Wgme

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

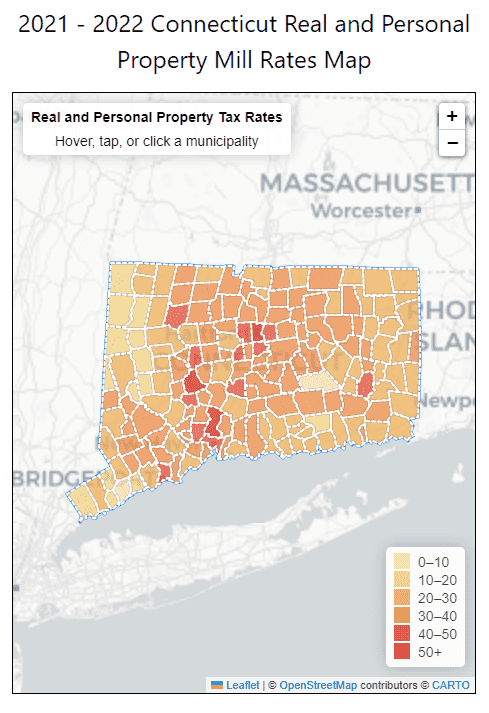

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

In This State Seniors Can Now Freeze Their Property Taxes Here S How Marketwatch

Maine Reaches Tax Fairness Milestone Itep

Maine Township Residents Pay Effective Property Tax Rates Of About 2 Far More Than Neighboring States Wirepoints

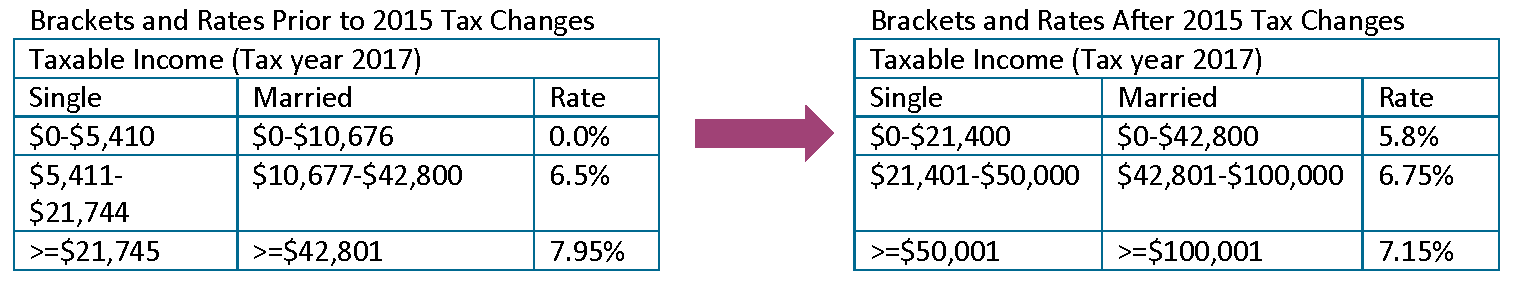

How Maine S Personal Income Taxes Work Mecep

Bangor S Property Tax Rate Will Drop But Homeowners Will Still See A Higher Bill

Map How High Is Your Town S Property Tax Rate Press Herald

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

How Do Marijuana Taxes Work Tax Policy Center

Assessor Commits 19 92 Property Tax Rate For 2020 21 Town Of Cape Elizabeth Maine

Opinion Property Tax Stabilization Program Shifts Burden To State Taxpayers The Maine Wire

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

How Do State And Local Property Taxes Work Tax Policy Center

State And Local Sales Tax Rates Midyear 2022

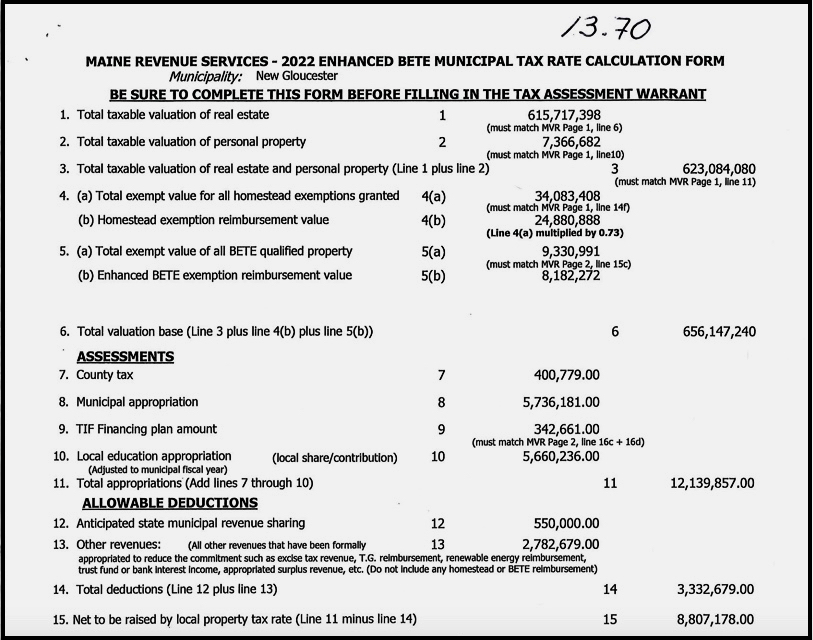

Select Board To Set Fy23 Tax Rate Hear Roads Analysis Upper Village Planning Update Ngxchange